Favorite Tips About How To Settle A Collection Debt

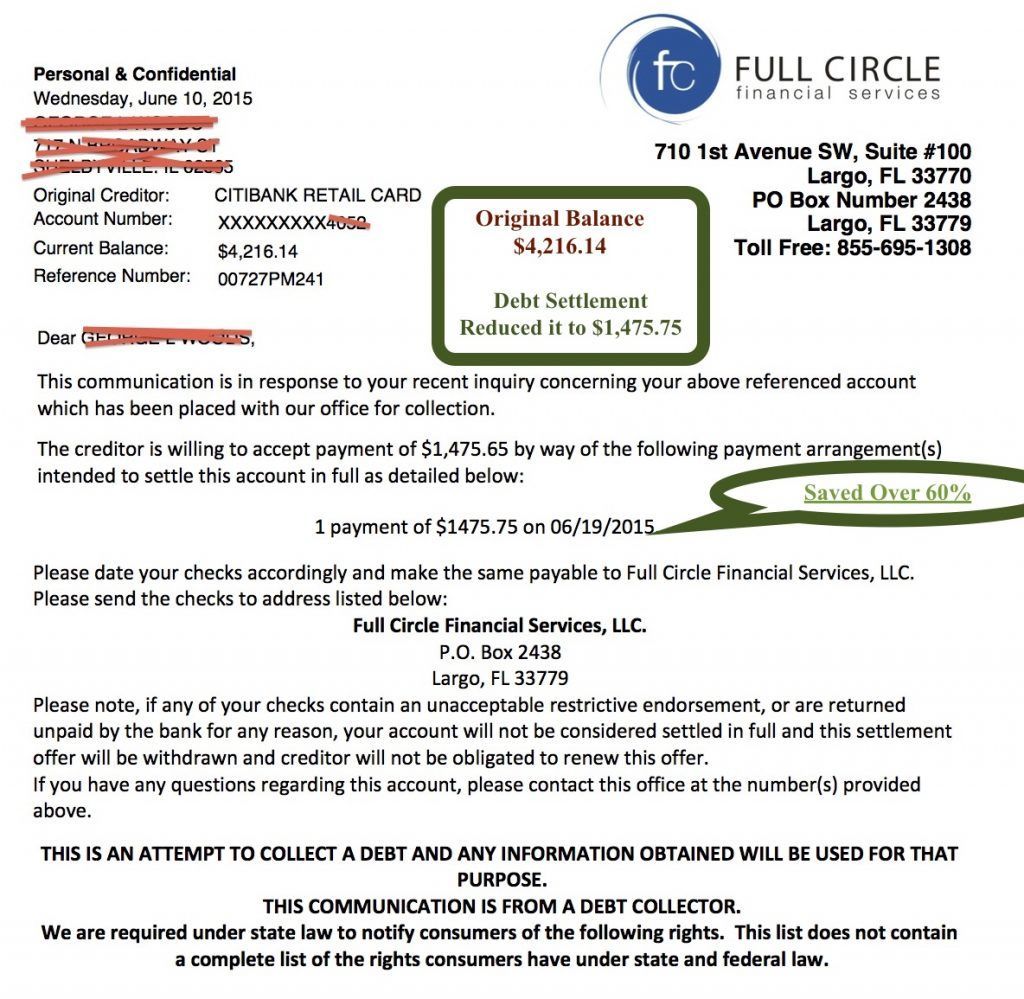

Settle the debt for less than you owe.

How to settle a collection debt. According to several experts, paying any amount above 50% is too high. Only communicate with debt collectors in writing & keep records. Pay your bill and watch your score as your paying the bill makes zero difference to your credit score since your debt was sold to collections.

If months or years pass, the collection agent is likely to greet any offer by you with enthusiasm. The first step is to identify the types of debt (s) you have and where they are at in the debt collection process in order to determine how to best settle a debt with a debt collector. If you settle the account after.

Tell the collector that you can’t afford to pay in full, but you. When dealing with a collection agency, start your negotiations low. Important tips when negotiating your debts.

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every. If you have any questions,. Let's talk about my debt.”.

Responding to a settlement offer. Knowing debt collection agencies and debt collectors purchase debt for pennies on the dollar helps to give some insight into a bill collectors motives and may help you keep. Gurstel law firm will likely sue you over your debt.

A debt collector will often begin negotiations by asking you to pay 80% of your total debt, forgiving only 20%. When you're speaking with a debt. Find a credit expert and pay them a whole lot of.